Are VA loan calculators found on websites accurate? While a mortgage calculator can help in getting a quick idea of what a payment would be, in most cases they will not be accurate enough for what will be one of the biggest purchases you will make in your lifetime.

PITI – Principal, Interest, Taxes, Insurance

The total monthly payment on a VA loan is made up of a combination of several factors, including loan principal, interest, property taxes, homeowner’s insurance, and in the case of a condo, the Home Owners Association Dues.

Many mortgage websites contain a loan calculator that can be used to calculate an estimated monthly payment. Most of these calculators take into account most of the important values like purchase price, estimated down payment, and estimated loan term and interest rate. While these values play a big role in the calculation of your monthly payment, there are other factors that are involved in your monthly payment that these calculators either assume or don’t include.

Factors that can Affect the VA Loan Payment

The first of these factors that play a role in shaping a VA monthly payment are the calculation of the VA Funding Fee. Knowing whether the Funding Fee is 1.25%, 1.5%, 3.3%, or 0 is something that most online calculators do not account for. Whether or not a veteran has previously had a VA loan or if they are a disabled veteran factors heavily into the size of the VA funding fee, or whether there is a VA Funding Fee at all.

Other factors that play into determining a monthly payment include the property tax rate of the property (which will vary from one geographic region to the next) as well as the Homeowner’s insurance (earthquake insurance, flood insurance, rural area, etc). Each of these factors can vary by the area that you live in and may be different than the assumptions that the calculator is using.

What Does a California VA Loan Scenario Look Like?

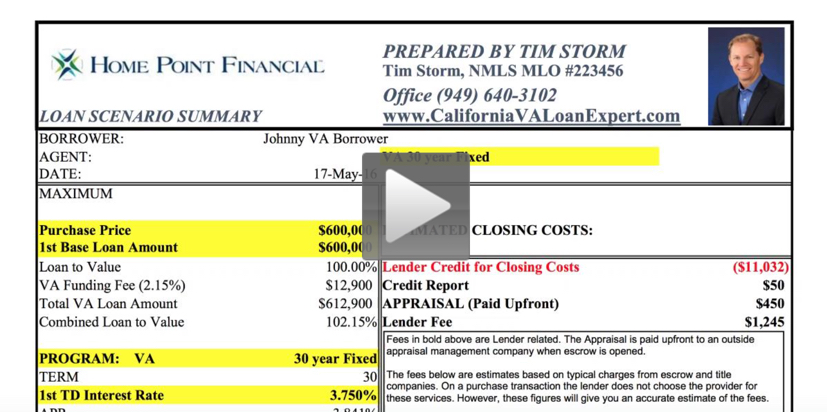

With my clients I will always prepare a custom VA loan scenario, which will have a thorough breakdown of the Veterans payment, closing costs, and amount needed to close. Knowing these numbers in the early stages of the home buying process is crucial. I prepared a quick “screen capture” video which will show you what a VA loan scenario looks like. Click Here for the video.

While researching loan options and gathering information it is extremely beneficial to get an accurate loan scenario from a California VA Loan Specialist. A loan scenario will provide a full breakdown of all the factors that will play into shaping a VA loan and the monthly payment as well as being customized to your specific situation. A complete loan scenario will also give the California Veteran an accurate estimate of the amount of money to close to close, if any.

Authored by Tim Storm, an Orange County VA Loan Officer specializing in VA Loan. MLO 223456. – Please contact my office at the Home Point Financial. My direct line is 949-640-3102. www.OrangeCountyVALoans.com. I will prepare custom VA loan scenarios which will be matched up to your financial goals, both long and short term. I also prepare a Video Explanation of the your scenarios so that you are able to fully understand the numbers BEFORE you have started the loan process.