VA loan limits for Orange County, CA will be eliminated as of January 1, 2020. This is a big change from what has historically been a limit on Veterans’ ability to purchase a home in Orange County with no down payment. With VA loan limits in California eliminated, usage of the VA loan program should increase significantly.

VA loan limits for Orange County, CA will be eliminated as of January 1, 2020. This is a big change from what has historically been a limit on Veterans’ ability to purchase a home in Orange County with no down payment. With VA loan limits in California eliminated, usage of the VA loan program should increase significantly.

How have the VA Loan Limits Been Set in Orange County?

Every N0vember, Federal Housing Finance Agency (FHFA) announces the Conforming Loan Limits for each county in the United States. The basic Conforming Loan Limit in 2019 for all counties in the United States was $484,350. But for counties where home prices are above the national averages, like in Orange County, the “High Balance Conforming” limit was set at $726,525. There were also many counties in California with limits set above $484,350 all the way up to $726,525. It just depends on the average sales price of homes in that county.

VA followed suit and set the Zero Down 100% financing VA loan limits to be equal to the Conforming (or High Balance Conforming) loan limit set by FHFA. So in Orange County in 2019 a Veteran could buy a home for $726,525 for No Down Payment. If the Veteran was to buy a home priced above the loan limit then they would need a down payment equal to 25% of the difference between the purchase price and the loan limit. For example, if a Veteran was to purchase a home in Irvine for $826,525 (an even $100,000 above the loan limit) then the down payment required would be $25,000 and the resulting VA loan would be $801,525. Now, in 2020, the Veteran can buy that same home with $0 down. The VA loan will be $826,525. This change will open up the options for Veterans to buy a higher-priced home in areas like Newport Beach, where the VA program has not been widely used. The elimination of VA Loan limits will also help Veterans looking to buy VA approved condos.

What about the Inland Empire?

Riverside County and San Bernardino County, or the Inland Empire, will benefit big time from this change. The Inland Empire’s loan limit was set at the basic $484,350 in 2019. That has made it difficult for Veterans looking to buy their first home in the Inland Empire only to find that homes in many areas were priced above $500,000. Now, the barrier to entry will be much easier to break through.

Riverside County and San Bernardino County, or the Inland Empire, will benefit big time from this change. The Inland Empire’s loan limit was set at the basic $484,350 in 2019. That has made it difficult for Veterans looking to buy their first home in the Inland Empire only to find that homes in many areas were priced above $500,000. Now, the barrier to entry will be much easier to break through.

How Does This Affect VA Refinancing?

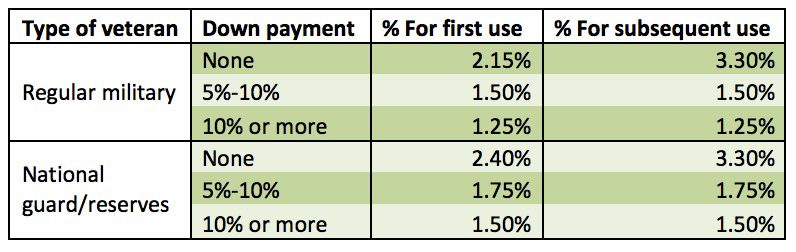

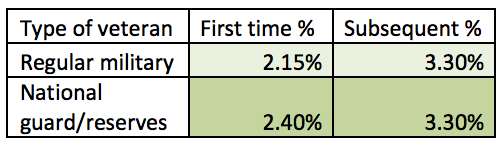

This will also help those Veterans who already own a home and are looking to refinance to pull cash out above the current VA loan limits. In 2019 VA did tighten the cashout refinance guidelines, making it difficult to pull cash out above 90% a properties value. And it is the “total VA loan amount” including the VA Funding Fee that has to be used in the 90% calculation. But 90% loan to value for a cashout refinance is still better than any other type of Conventional or Government loan program for 1st mortgages.

This will also help those Veterans who already own a home and are looking to refinance to pull cash out above the current VA loan limits. In 2019 VA did tighten the cashout refinance guidelines, making it difficult to pull cash out above 90% a properties value. And it is the “total VA loan amount” including the VA Funding Fee that has to be used in the 90% calculation. But 90% loan to value for a cashout refinance is still better than any other type of Conventional or Government loan program for 1st mortgages.

Eliminating the loan limits means a Veteran who is looking to pull cash out on a property valued at $1,500,000 could get a new VA loan of $1,350,000. At least theoretically. It is important to mention that VA issues the underwriting guidelines but does not actually fund VA loans. Bank fund VA loans. As of this writing, we are still waiting to see how aggressive the banks will get with cashout refinancing are Super Jumbo loan programs.

2020 will be a big year for the VA loan program. Veterans who typically didn’t take a serious look at the VA loan should now learn more about and compare it to other financing programs. VA tends to have lower 30 year fixed rates than other programs, especially in the lower FICO score ranges. Also, the debt to income ratios are not limited to 43% like most Conventional Jumbo loan programs. And only a 2 year wait period is required after a bankruptcy or foreclosure, compared to 4 to 7 years for other types of loan programs. And best of all, even though no down payment is required, there is no monthly mortgage insurance like there is on Conventional loan programs when the loan to value is above 80%.

If you are a Veteran considering a home purchase or refinance, make sure you talk to a Loan Officer who is knowledgable with the VA loan program.

Authored by Tim Storm, an Orange County, CA Loan Officer specializing in VA Loans. MLO 223456. – Please contact my office at Fairway Independent Mortgage Corporation. My direct line is 714-478-3049. I will prepare custom VA loan scenarios which will be matched up to your financial goals, both long and short-term. I also prepare a Video Explanation of your scenarios so that you are able to fully understand the numbers BEFORE you have started the loan process