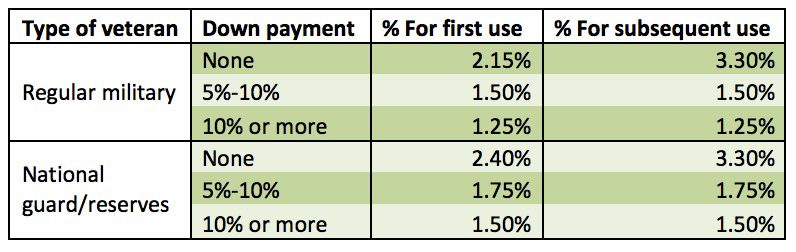

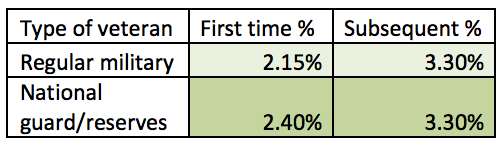

The VA Funding Fee is unique to the VA mortgage program. The funds from this fee go directly to the VA to help cover any losses from loans that default. The VA funding fee is an amount equal to a certain percentage of the loan amount which is based on a variety of factors. These factors include the type of military service performed, whether a down payment is going to be paid with the loan, and if this is the first time using the VA program or a subsequent use. The borrower has the option to either pay the funding fee in cash at closing or to include the funding fee into the financed loan amount. It is extremely rare that a Veteran chooses to pay the VA Funding Fee out of pocket versus financing it into the loan, but it is possible.

Funding Fee Exemption

The VA does allow exemptions to the Funding Fee, but only for a few eligible groups. The main group that is exempt from paying the VA funding fee are veterans that have a service-connected disability rating. The other group that is exempt are surviving spouses of Veterans who died in the service, or as a result of service-related disabilities.

These two charts below include some addition information regarding how the percentage paid for the VA funding fee is determined. This first chart provides information for VA purchase loans:

This second chart provides the percentage details for VA cash-out refinance loans:

Authored by Tim Storm, an Orange County VA Loan Officer specializing in VA Loan. MLO 223456. – Please contact my office at the Home Point Financial. My direct line is 949-640-3102. www.OrangeCountyVALoans.com. I will prepare custom VA loan scenarios which will be matched up to your financial goals, both long and short-term. I also prepare a Video Explanation of your scenarios so that you are able to fully understand the numbers BEFORE you have started the loan process.