Buying a home in Orange County is super competitive in 2022 no matter what type of financing a home buyer is using for the purchase. But for those Veterans using a VA loan in Orange County to purchase a home, they will find the competition to be extra challenging. What is it that makes it more difficult to use the VA loan to buy a home versus other types of home loans?

Why are Sellers are Afraid of the VA Loan Program?

I've been closing VA loans in Orange County, CA for over 30 years. When I first got in mortgage lending the VA loan program was not widely used, since only Veterans, Active Military, and surviving spouses (in some circumstances) have access to the program. But because of how the market was in 1990, it wasn't that difficult to get an offer accepted for a Veteran using the VA loan to buy their home. Still, it was generally accepted and expected that the seller would pay for most of the Veterans closing costs and that their may be repairs required by the VA appraiser (or termite inspection) that would need to be completed prior to the closing of the loan. Back in the 90's, before the internet took hold, it took longer to close a VA loan. Retrieving the Certificate of Eligibility was hard work. More than once I personally drove from Orange County to the downtown Los Angeles VA office to file paperwork at "the window" and get the paper COE for a client. Although compliance wasn't as difficult then as it is now, VA loans just took longer to close than other types of loans. Another important restriction that got in the way of the VA loan program was the loan limit for $0 down financing.

That was then and this is now. That VA loan limit thing made it very hard for a Veteran to buy a home in Orange County prior to 2008. In 2005 the median home price in Orange County was $719,619. The VA loan limit was was $359,650. Needless to say, there were a few years there where the VA loan program barely existed in Orange County because of high home prices. Veterans were bypassing the VA loan program altogether and instead using risky "80-20" programs, along with anyone else who wanted to buy a home with $0 down payment. After the mortgage meltdown in 2006, changes were made and the VA loan limits were dramatically increased. By 2009 the VA loan limit for $0 down financing in Orange County was $737,500. The median home price in Orange County had dropped to $544,300. This made the VA loan program more popular than ever, at least in Orange County.

VA Loan Limits removed in 2020

2020 was a huge year for the VA loan program. There were now no restrictive loan limits for 100% financing using the VA loan program. In Orange County, where the Median home price reached $950,000 in 2020, being able to buy a home with no down payment, even if the price were $1,500,000 or more, meant the VA loan program was again the best financing option for nearly any Veteran buying a home. But as the market heated up, it became more difficult to get an offer accepted from a Veteran using the VA loan. There are several reasons for this, but the most typical goes back to old, commonly held, beliefs about the difficulty in closing a VA loan. Below are a few common "myths" about the VA loan program.

- Seller has to pay the Veterans closing costs. This is not true. Back in the day (like in 1990) it was very common for sellers to pay the VA buyers closing costs, but it wasn't mandatory. The rules for "non-allowable" costs eased and became more clear in later years. While a lender does need to be cognizant of certain fees, it's important to understand the 1% rule. Basically, fees that VA considers "non-allowable" need to be less than 1% of the loan balance. The biggest fees included in the 1% calculation include the escrow fee, notary, and lender Origination fees. Fees that are not included are Title, appraisal, recording, and discount points. The escrow fee tends to be the biggest "non-allowable" fee. The formula most escrow companies use to determine their fee does not result in anything near 1% of the loan amount, unless the purchase price is under $150,000. But that doesn't happen in Orange County, so we will rarely if ever need to worry about hitting the 1% cap.

- Seller has to pay repairs. This is not true. VA is just like any other type of financing when it comes to paying for repairs. While VA does require a clear termite report, it does not require the seller pay for the repairs. In a competitive real estate market, a Veteran can choose to pay for repairs. It's all negotiable.

- VA Appraisers are conservative. Not true. VA appraisers are also Conventional loan appraisers. The valuation process is the same for a VA appraisal as it is for any other type of appraisal.

- Veterans have no "skin in the game" making their offer less likely to close. This is definitely not true. The VA loan program has for years had the lowest default rate of any other loan program. And why should a seller be concerned about the percentage of down payment when they will get their money whether it comes from a VA loan or someone paying cash. If the Veteran is working with a local Orange County VA Lender and has gotten a Fully Underwritten VA Approval, their offer is as solid, if not more solid, than any other offer.

- VA Loans take longer to close. I'll say this is not true, but there are loan officers and lenders who don't close many VA loans, which can make the processing of a VA loan challenging. For an Orange County Loan officer who specializes in VA loans, the VA program can be the easiest loan program to close. And fast. VA is more flexible than other programs when it comes to credit, debt to income ratios, and of course down payment. There are less hurdles to closing a VA loan than any other type of Conventional financing. Any lender who tells you different is not a VA specialist.

The Challenge of Buying a Home with a VA Loan in a Super Hot Sellers Market

Buying an Orange County home in 2022 is a challenge no matter what type of loan you are using. Sellers are getting anywhere from 5 to 50 offers on their homes in the first week on the market. Many times the winning bids are those who are willing to pay more than the potential appraised value, which can quickly rule out any buyers with less than 10% down. This does make it extra challenging if a VA borrower is planning on $0 down financing. So how does a Veteran in Orange County compete?

How Veterans can make a Competitive Offer in Orange County?

There are strategies that will help make a VA offer more competitive than other offers. For most of 2021 and into 2022 we have been in an extreme "sellers market" due to a big imbalance between the supply of homes available for potential home buyers and the number of buyers who want to own a home. Here is what you need to do to compete with other buyers who may be less prepared.

- Get Fully Approved BEFORE you make an offer. This is very important. Do not wait until you've already found a home to get PreApproved. And if a lender gives you a "PreApproval" without reviewing your documentation then just know that you are NOT PreApproved. And if a lender gives you a PreApproval without verifying income or assets and having an underwriter sign off on the approval, then you are not actually PreApproved. To make sure you are fully PreApproved, you will want to go with a lender who will send your loan into an underwriter. Not many lenders will do this. Fairway Independent Mortgage Corp does a full approval, which is known as the Fairway Advantage. If you have a fully underwritten Fairway Advantage approval then you will be in position to remove the loan contingency immediately.

- Offer a shortened inspection contingency. Buyers will use the inspection as a way to back out of a transactions. If you are serious about wanting a home then offer a short inspection time period. Get the inspections done in the first few days of escrow.

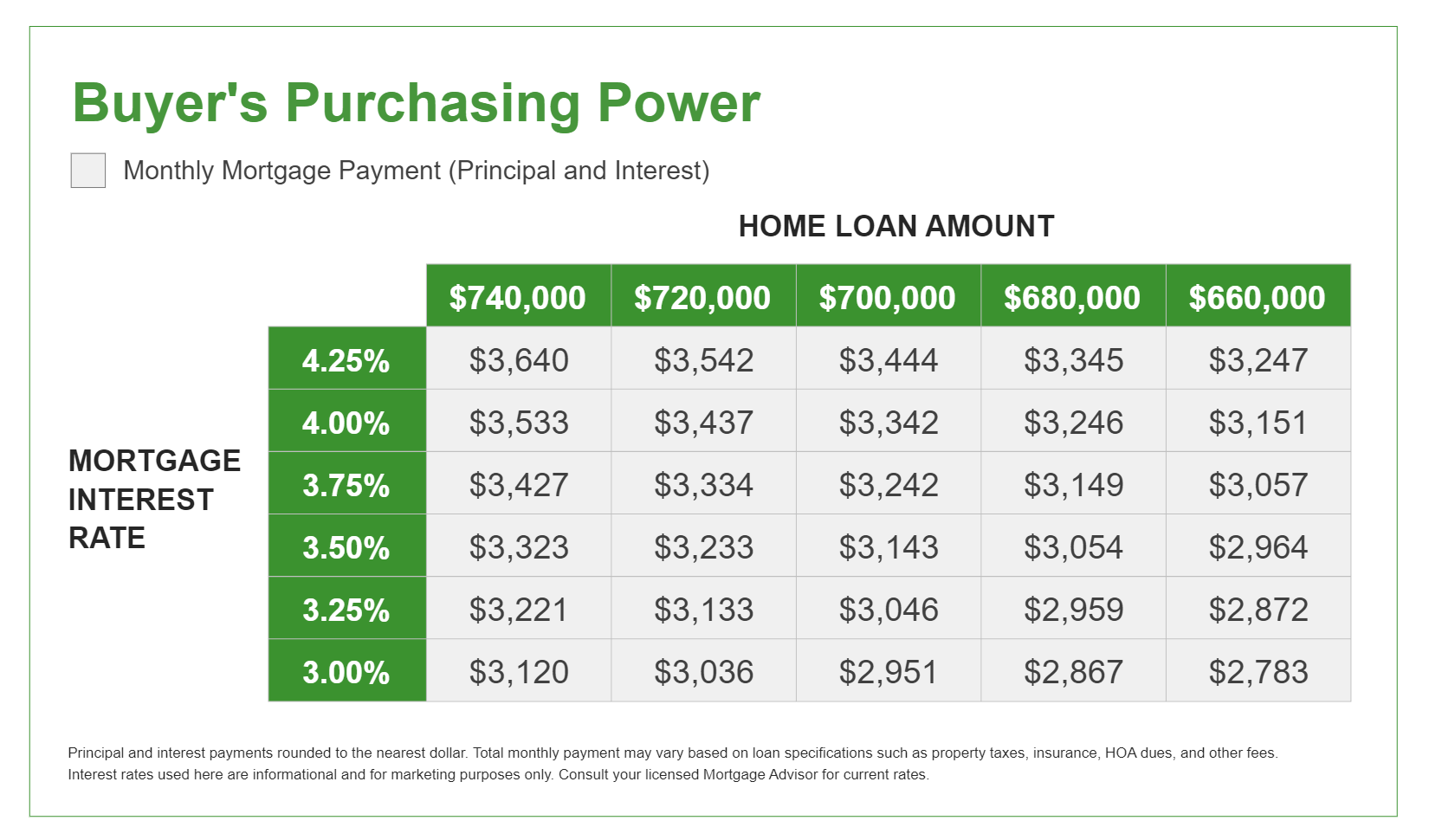

- If possible, offer at least a partial appraisal waiver. While someone who has a large down payment may be able to waive the appraisal contingency, even someone with a minimal down payment or no down payment can potentially set a "floor" for the appraised value. For example, let's say the offer price is $710,000 but the potential appraised value is $700,000. Maybe even lower. If the Veteran has $10,000 available then they could adjust their offer to allow for an appraisal as low as $700,000 even though their purchase price will be $710,000. If the appraisal comes in at $690,000 then the buyer still has an "out" since it was not a full appraisal waiver. This is also known as an appraisal gap strategy.

- Allow the seller to "rent back" for free up to 60 days after closing. This can put your offer at the top of the pile. The seller is going to be a buyer on their next home and will be dealing with the same hot market that you are dealing with. They may not have a new home lined up yet. By offering a seller "rent back" for free or a minimal dollar amount it will allow the seller to make non-contingent offers and potentially close very fast on their next purchase. I've had several VA clients who have used this strategy to get their offer accepted. The maximum time period for a rent back is 60 days since that is the time period allowed before the buyer has to move into the home to meet the "owner occupancy" requirement for a VA loan. This is true of any Conventional loan where the home is a Primary residence.

Buy your Home Before Values go Higher in 2022

Property values are expected to increase in 2022 by between 5% and 9% depending on who you are listening to. This means that a home valued at $700,000 today will be valued at $735,000 - $763,000 in 12 months, Why wait? Find out what the numbers look like for your potential purchase using the VA loan program. Have us prepare a VA Purchase Analysis based on what you qualify for, what your payment comfort level is, and what fit's in your budget.