Orange County Home Buyers who are eligible for the VA loan program have a great benefit available to them when it comes to financing a home. However, there are four questions that every Orange County Veteran home buyer should research and ask themselves before purchasing a home.

Orange County Home Buyers who are eligible for the VA loan program have a great benefit available to them when it comes to financing a home. However, there are four questions that every Orange County Veteran home buyer should research and ask themselves before purchasing a home.

-

What are my reasons for buying a home right now?

Purchasing a home should almost never be purely a financial decision. There are many other reasons that should weigh heavily on the decision to buy a home. Finding the right space for your family and finding a community that you feel safe in are big reasons that buyers should be considering when looking for a home. And of course, owning a home can also act as a major savings investment since a home can act as a major source of stored equity.

When looking to purchase a home, think to yourself “what am I looking for in a home for my family?” and “what am I trying to accomplish by purchasing a home?”. Being able to answer questions like these will help you be satisfied with your reason for whether or not to purchase a home.

-

What is expected to happen with Orange County property values in the next 12 to 24 months?

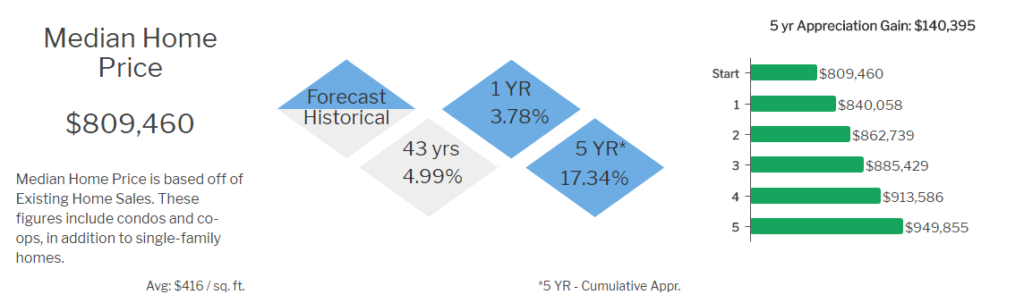

Property Values in Orange County are expected to continue rising. Chapman University and Cal State Fullerton economic forecasters are predicting a rise in prices in 2018 anywhere from 5% to 6%. A more conservative study by MBSHighway estimates Orange County price appreciation at 3.78% and 17.34% over the next 5 years.

A small inventory of available homes for sale has been a common problem over the past several years. Orange County remains one of the most popular markets in the country so when a home is listed for sale, it usually isn’t around for long. ReportsonHousing.com has reported that the typical home in Orange County will go into escrow after 55 days. Many homeowners are looking to sell but the small inventory of homes for them to potentially purchase scares them into staying put. There are also a variety of financial issues that are causing homeowners to not look to sell their home. Since values have risen, the costs related to closing have also increased which could leave the seller with less money than they would want. If homeowners have been living in their home for a very long time they will likely not want to give up their currently low mortgage and property tax rates. And if they’ve lived in their home a really, really long time, they may run into a capital gains tax consequence if they sell their home.

For Veteran homebuyers choosing the VA loan program, rising property values will be a huge long-term benefit. Since there is no down payment required by the VA program up to the Orange County VA loan limit (currently $679,650 in 2018), any increase in property value results in an exponential level of return from your investment in the property.

Going into 2018, it was widely predicted and expected that mortgage rates were going to climb. There has been a steady growth of new jobs created which has resulted in a growth in wages. This had led to a growth in the inflation rate, which is bad news for mortgage rates. At the beginning of 2018, Fannie Mae/Freddie Mac predicted interest rates would rise to 4.5%. The Mortgage Bankers Association predicted 4.6%. Realtor.com predicted an average of 4.6%, reaching 5% by year-end. Mortgage rates are already in the 4.5% range and appear to be heading higher as the economy strengthens. And remember, the property value appreciation is expected even though interest rates are going up. And that leads us to the next question a homebuyer should ask themselves.

-

What is the Cost of Waiting to buy a home?

Even though property values are higher than they were a few years ago and it might seem like you should wait to purchase a home, waiting could actually end up costing you thousands of dollars. Property values have increased and are expected to continue to increase. Mortgage rates are also rising and expected to continue rising to nearly 5%. While you may be waiting so that you can meet certain conditions to buy a home, the necessary conditions and market environment are also changing. The Cost of Waiting is a way of comparing the current cost of buying a home to the future cost of buying the same home. For example, let’s say a Veteran is looking at buying a home for $600,000 with no down payment using VA financing. Assuming an interest rate of 4.5% (APR 4.71%), the PI portion of the payment would be $3,040. Property taxes, assuming a 1.25% tax rate would be $625. We’ll estimate the homeowner’s insurance at $100 per month. The total PITI is $3,765. If the Orange County Veteran waits 1 year to buy the same home and property values and interest rates have met expectations, the new home price would be between $622,680 and $630,000. We’ll go with the conservative estimate of $622,680. The PI would be $3,342 (5% note rate and 5.22% APR). Property taxes would be $648. The total PITI would be $4,091. That is a $326 payment increase just because they waited a year. When you also consider that if the Veteran bought the home today, then in 12 months he would have paid enough principal into his loan to lower the balance from $600,000 to $590,320 and you begin to really see the power of a Cost of Waiting Analysis. By waiting one year the homebuyer has lost out on over $30,000 in equity and has a payment that is $326 higher.

Getting PreApproved for a VA loan BEFORE you start the home buying process is the first step.It is very important to make sure that the mortgage payment will fit into your family budget. Having money left over for savings, retirement, vacations and going out to dinner now and then is a very important factor in determining what home price to buy. The first thing an Orange County Veteran should do at the start of the home buying process is to talk to an Orange County VA Loan Officer. Your VA loan officer should be able to answer all of your VA loan questions and put together custom VA loan scenarios that will match up with the home price you qualify for, taking into consideration the payment you are comfortable with. You can see a great example of the numbers for purchasing a home in California with VA financing right here.

Authored by Tim Storm, an Orange County, CA Loan Officer specializing in VA Loans. MLO 223456. – Please contact my office at Fairway Independent Mortgage Corporation NMLS #2289. My direct line is 714-478-3049. I will prepare custom VA loan scenarios that will be matched up to your financial goals, both long and short-term. I also prepare a Video Explanation of your scenarios so that you are able to fully understand the numbers BEFORE you have started the loan process.