It's getting easier to get a VA Loan offer accepted in Orange County, CA. The last few years have been tough for home buyers using VA financing. Even though VA is a very easy loan to close, at least for lender who specialize in VA financing, sellers have always shied away from VA buyers. The reason vary and are mostly due to misinformation, old information, and "myths" about the VA loan program. But what made it even harder for VA buyers since the beginning of COVID was the extreme shortage of homes for sale.

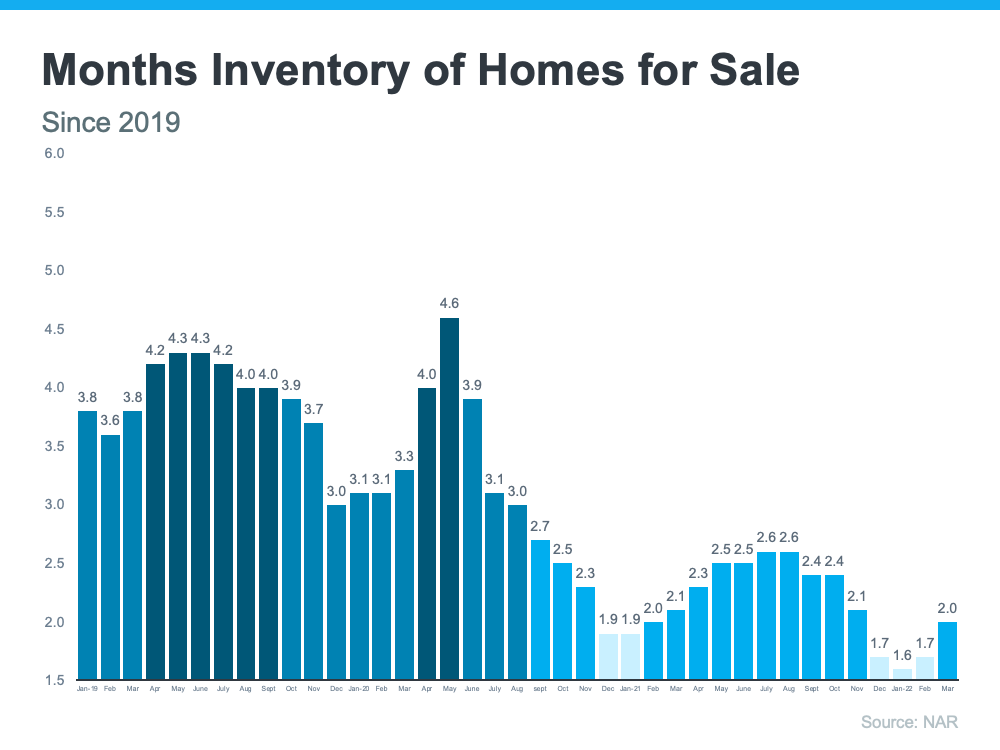

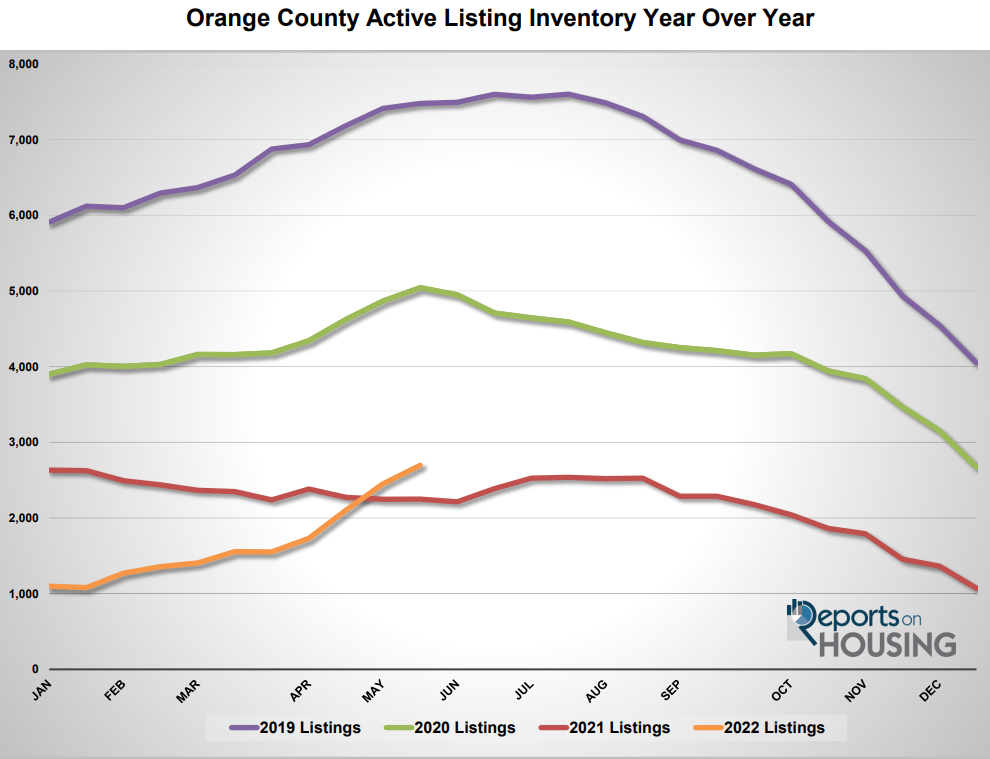

Supply Shortage = Extreme Sellers Market

When COVID started in early 2020 the real estate market had slowed down. Home buyers and sellers put their plans on hold. Sellers didn't want people walking through their home and buyers were facing their own disruptions. Within months things changed. Employers allowed their employees to work from anywhere. Demand from homebuyers increased quickly, but with very little supply on the market home prices began to rise quickly. To complicate things even more, mortgage rates dropped to record levels, making home financing cheap. This just added more buyers to compete for a limited supply of home. I've heard the real estate market during this period called an Extreme Sellers Market and a Insane Sellers Market. In Orange County and the rest of southern California (and the whole US) there were anywhere from 20 to 40 or more offers on every home. It didn't matter if the home needed work or was in a poor location. Everything sold quickly and for more than the listed price.

In a normal balanced market the listing price is what the seller is hoping to get for tor the sale of their home. They may get a few offers under or above the listing price and after some negotiations they may even help pay some of the buyers closing costs. But during the Extreme Seller Market of 2020 and 2021 the list price was more of a starting point. A floor price. Bidding wars ensued. The buyers that had the best shot at winning a bidding war were those with a big down payment or even just straight cash buyers. These buyers could waive the appraisal, paying above the appraised value. Plus they could waive the inspections, which is crazy but is what it took in some situations.

And this is why VA buyers had a very difficult time getting an offer accepted. A VA buyer planning to take advantage of 100% financing was usually not in a position to pay more that the home would appraise. If there were 20, 30, or 40 offers, the listing agent needed to quickly eliminate the weakest offers. A 100% financing offer was considered a weak offer in this scenario. Even Veterans who had a fully underwritten PreApproval and were willing to waive the loan contingency faced the challenge of competing against offers from other buyers bidding above what the property would appraise for.

Why is it Now Easier for VA Buyers in 2022

2022 has gotten off to an interesting start. Mortgage rates began rising immediately after the New Year. My May mortgage rates are more than 2% higher than they were in 2021. This has helped to put a damper on demand (the numbers of buyers actively looking to buy a home). Sellers are more willing to consider offers from buyers with low down payments, including VA buyers with $0 down payment. Homes are sitting on the market longer, resulting in increased inventory. There are now fewer offers to compete with. It is still a sellers market in Orange County and southern California, but it's not as bad as it was a few months ago.

What a VA Buyer should do to be as competitive as possible

There are things that any buyer should do before they begin their home search. And especially before they make an offer. It's even more important for VA buyers to get "all of their ducks in a row".

- Get a Fully Underwritten PreApproval. Each lender seems to have their own definition of what a "fully underwritten PreApproval" is. Most lenders will just have a loan officer do a quick review and run the loan through Desktop Underwriter, which is Fannie Mae's automated underwriting engine. The problem with this is if the loan officer calculates income differently from what a VA underwriter calculates, then the loan could be declined in the middle of escrow. Some lenders, like Fairway Independent Mortgage Corporation, will do a full processing of the loan. Loan Disclosures are sent out as if the VA buyer already has an accepted offer. Income and assets are documented and VERIFIED using Verification of Assets and Verification's of Income. Then the loan is submitted to an underwriter for a full review and approval. Typically a Conditional VA Loan Approval is then issued. The non-property related conditions are then cleared. This is known as the Fairway Advantage Approval Program. The Fairway Advantage take the stress out of the homebuying process.

- Cash Guarantee. Fairway Independent Mortgage includes a Cash Guarantee to the seller when the buyer has gone through the Fairway Advantage program. Fairway guarantees the loan will close, and on time, or Fairway will either buy the property to close the transaction or will issue the seller a $10,000 check if the seller wants to keep the property and try to sell again. The guarantee is triggered if financing falls apart due to a financing reason. For example, if the buyers loses their job in the middle of escrow and is no longer qualified to buy the home, Fairway will buy the home. If the buyer purchases a car and takes on a big payment and no longer qualifies (this would not be smart on the buyers part, but you never know) Fairway will buy the property. If the appraisal comes in low then Fairway will either buy the property for the lower of the appraised value of the purchase price. If the seller wants to put the home back on the market, Fairway will give the seller $10,000. This is Fairway Mortgage's way of getting the point across that it stands behind it's Fairway Advantage home buyers.

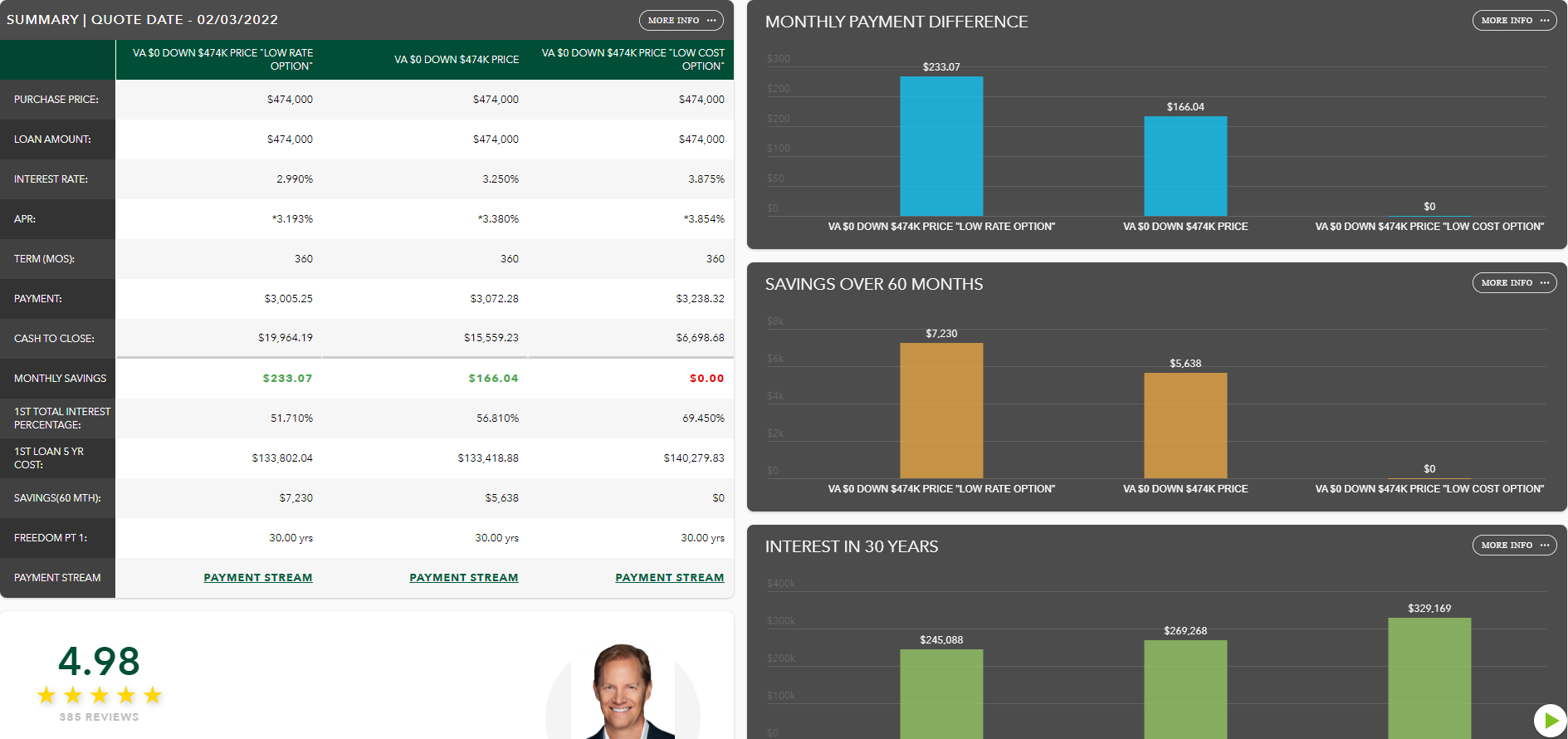

- Get a VA Purchase Analysis before making an offer. It is important to know the numbers before making an offer. The VA lender should be able to present the numbers in a clear and concise manner so that the buyer has a very accurate idea of what the full payment will be including taxes, insurance, and HOA dues. And the VA Purchase Analysis should also have a fairly accurate estimate of how much money will be needed to close escrow. Even though VA does not require a down payment, there are still closing costs and Prepaid expenses that need to be covered. Knowing how much will be needed will eliminate surprises at the closing table.

Request your FREE VA Purchase Analysis

The first step in the home purchase process is to request a Purchase Analysis. In this case, a VA Purchase Analysis. The VA Purchase Analysis will give you a clear and concise breakdown of the numbers you need to know, side by side.

FREE VA Loan Purchase Analysis