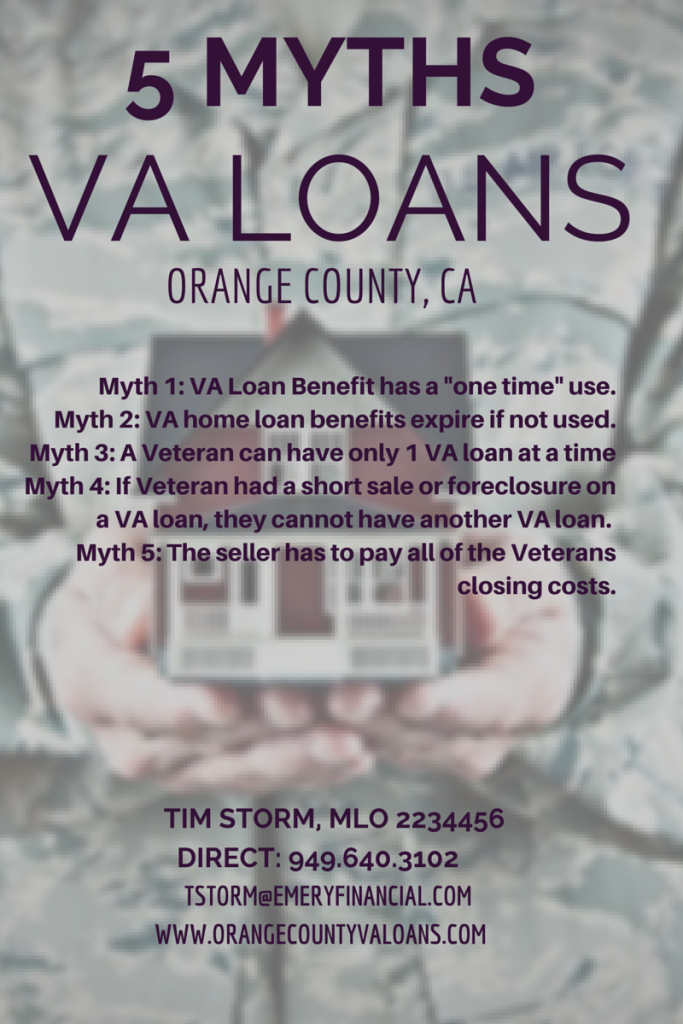

The VA mortgage program is a fantastic benefit that has made the Orange County home buying process much easier for our Veterans. However there are a few myths and misunderstandings about the program that sometimes cause veterans to look at different programs when buying a home. Here are 4 of the most common myths about the VA program…

Myth #1: You need perfect credit for a VA loan

The VA acts as an insurer for VA loans to offset the risk of a potential default. VA does not have a minimum FICO score requirement. However, because VA loans are sold on the secondary market, lenders do have their own requirements. Many VA lenders will look for a credit score of at least 620. That 620 score is an arbitrary limit that is self-imposed by some lenders, so there will be some lenders that will close a VA loan with FICO scores of 580 or even lower. If you are looking for a VA loan and the first lender you visit won’t accept your loan request, it is worth looking to see if you can find a different lender that will accept your request. Also, VA only requires a 2 year wait period after a bankruptcy or foreclosure. And no wait period after a short sale.

Myth #2: VA loans take longer to close than other types of loans

The VA loan program has become a faster and more streamlined process. According to Ellie Mae, VA  and Conventional loans both on average close in about 43 to 46 days (2017 statistic). On top of that VA loans are also more likely to close than a conventional loan. Because the VA loan program is a “niche”, Veterans should seek out lenders and loan officers who specialize in the VA loan program. An Orange County Loan Officer who specializes in VA loans should have no trouble closing a VA loan in 30 days or less. (or even 22 days)

and Conventional loans both on average close in about 43 to 46 days (2017 statistic). On top of that VA loans are also more likely to close than a conventional loan. Because the VA loan program is a “niche”, Veterans should seek out lenders and loan officers who specialize in the VA loan program. An Orange County Loan Officer who specializes in VA loans should have no trouble closing a VA loan in 30 days or less. (or even 22 days)

Myth #3: VA loans are risky loans

The no down payment aspect of a VA loan may make it seem like it’s a much riskier loan. However, VA loans have the lowest foreclosure rate when compared to other Conventional programs. VA is unique in that not only is the Debt to Income ratio reviewed, but a Residual Income calculation is also reviewed. No other loan program reviews Residual Income in the way that VA does.

Myth #4: VA loans can only be used one time

Many Veterans in Orange County think that the VA loan program can only be used once or your eligibility expires after a certain period of time, which is simply not true. The VA program is a lifelong benefit that Veterans are able to use multiple times. Every Veteran has a “basic entitlement” with the VA loan program, which represents the amount of their loan guaranteed by the VA. Once their first loan has been paid off and their entitlement has been reestablished or restored, they are able to get another VA loan. On top of that, it is important to understand how Bonus Entitlement works and how it is possible for get a VA loan even if your Certificate of Eligibility shows “Zero” Entitlement.

For more questions about the VA loan program or to receive custom VA loan scenarios, please call Tim Storm at 949-640-3102.

Authored by Tim Storm, an Orange County VA Loan Officer specializing in VA Loan. MLO 223456. – Please contact my office at the Home Point Financial. My direct line is 949-640-3102. www.OrangeCountyVALoans.com. I will prepare custom VA loan scenarios which will be matched up to your financial goals, both long and short term. I also prepare a Video Explanation of the your scenarios so that you are able to fully understand the numbers BEFORE you have started the loan process.