Orange County veterans have a number of financing options when it comes to buying a home. But, the VA home loan is often the best option for those who want to maximize their purchasing power and take advantage of the many benefits that come with this type of loan. In this post, we'll explore why the VA home loan is a great choice for veterans in Orange County and offer some tips on how to get started. So, whether you're ready to buy your first home or are considering refinancing your existing mortgage, keep reading to learn more about the VA home loan!

Home Financing Options for available to Veterans in Orange County

There are several home financing options available to Veterans. Many of these options are available to non-Veterans as well .There are only a few programs that are exclusive to Veterans. Below are programs that should be considered.

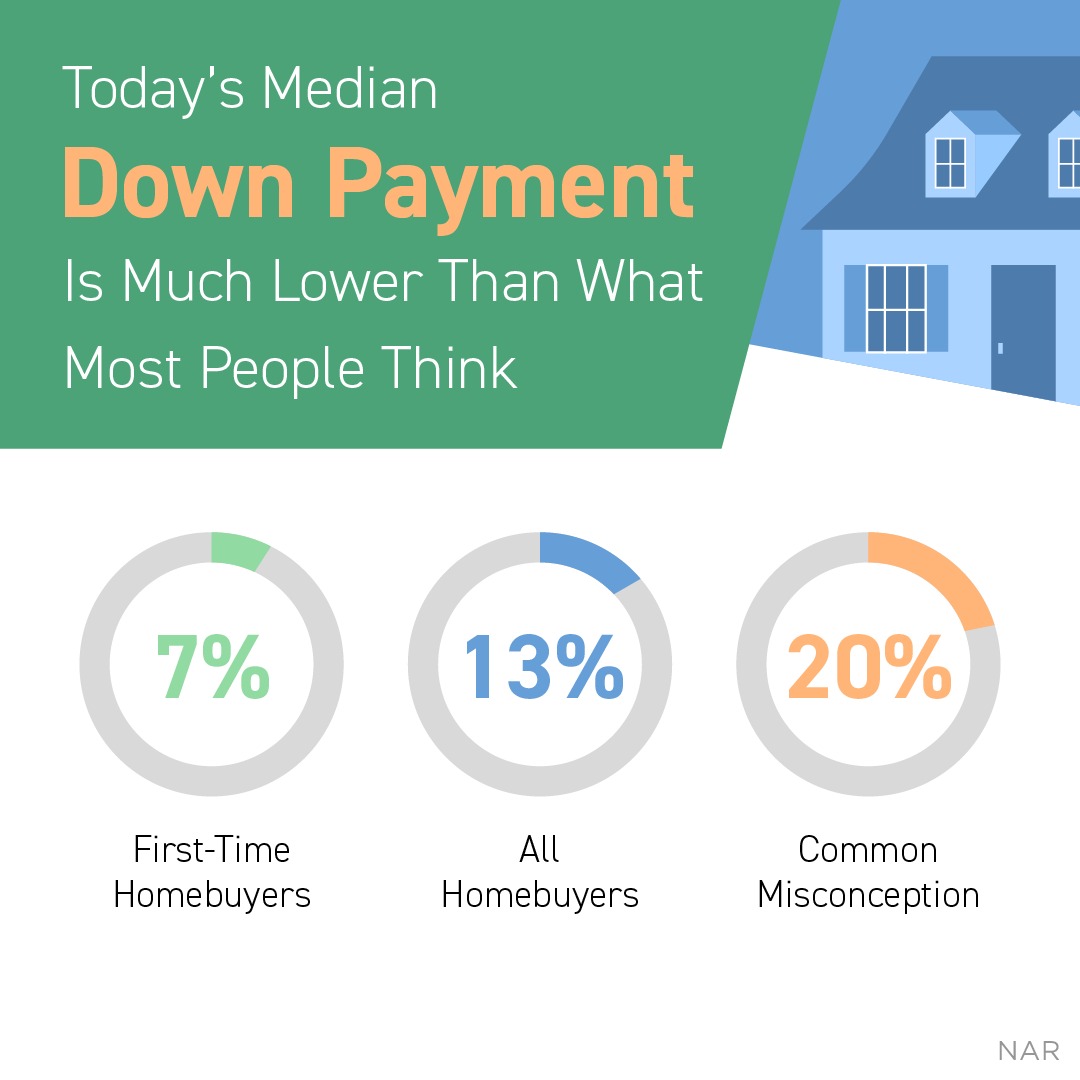

- Conventional Loan - This is typically a Fannie Mae or Freddie Mac loan program. Conventional loan programs allow for down payments as low as 3% up to the base Conforming loan limit ($726,200 in 2023) and 5% down up to the High Balance Conforming loan limit ($1,089,300 in 2023). The maximum debt to income ratios are 50%, and depending on the credit of the borrower the max DTI could be less. FICO scoring is very important on Conventional financing. The interest rate on Conventional financing can be greatly affected by FICO scores below 720. Loan Level Price Adjustments, or LLPA's, adjust the pricing (interest rate) based on a borrowers FICO score, property types, down payment, property usage. A Veteran putting 20% down may consider Conventional financing, especially if the Veteran does not have a VA Funding Fee waiver (for having a service connected disability rating).

- Jumbo Loan - This type of home loan is similar to a Conventional loan but is meant for home buyers in need of financing that is above the Orange County Conforming loan limit of $1,089,300. The down payment requirements are typically at least 10% and reserves (savings in the bank) after the closing are required on most Jumbo home loan programs. A Veteran may consider a Jumbo loan if they are purchasing a home with a large down payment (20% or more).

- Non-QM - This type of loan is for borrowers who do not fit into typical full income documentation loan programs (Conventional, Jumbo, FHA, VA, etc). Self employed borrowers are an example of someone who may benefit from a Non-QM type program. Non-QM programs allows for deriving income from deposits on bank statements rather than using paystubs and tax returns. The trade off in the interest rate on a Non-QM loan can be quite a bit higher than other types of full income documentation financing. A Veteran may consider a Non-QM loan if they are self employed or have other qualification limitations. (bankruptcy less than 24 months old, buying an investment property, non-warrantable condo)

- FHA - This is a government loan program that only requires 3.5% down payment up to the Orange county loan limit of $1,089,300. It has fairly flexible income and credit requirements. Many lenders will allow FICO scores as low as 580 (some even lower). The maximum "debt to income" ratio is 57% when run through one of the two main Automated Underwriting engines. The FHA home loan does have an Upfront Mortgage Insurance Premium of 1.75% which is financed into the loan and also has monthly mortgage insurance, which in most cases will remain for the life of the loan. A Veteran may consider using FHA financing if their entitlement for VA financing is being used and is not restored.

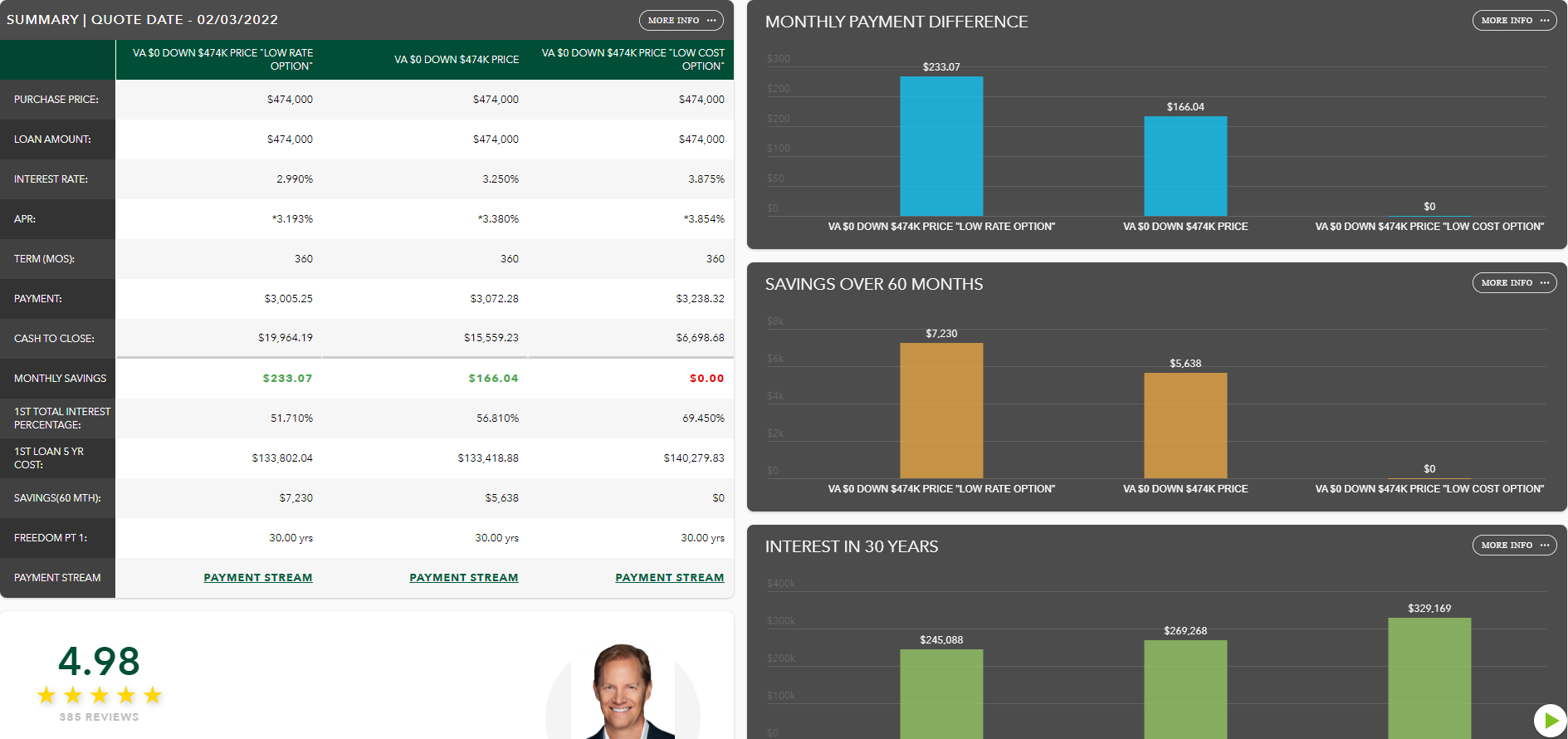

- VA Loan - This program is only available for eligible Veterans. An Orange County VA lender can retrieve the VA Certificate of Eligibility to verify entitlement for the program. VA allows for $0 down. There are no loan limits for VA loans, which means a Veteran can buy a home at any price with $0 down payment. Also, there is no monthly mortgage insurance, even when the down payment is less than 20% (all the way down to $0 down payment). There is a VA Funding Fee which is financed into the loan. It does not affect the cash to close and it is waived for Veterans with a 10% or greater service connected disability rating. VA does not have a maximum Debt to Income ratio, instead looking closely at the "residual income" calculation. VA is also more lenient than other program when it comes to credit. Bankruptcies and foreclosures need only be seasoned for 24 months. VA is offered by any VA approved lender and interest rates are determined based on the secondary market for Ginnie Mae Mortgage Backed Securities. Rates are not set by VA.

- CalVet Home Loan - this is also only for Veterans. In many ways the standard VA loan program will be better for most Orange County Veterans, but there are situations where CalVet is the better option. CalVet will lend on mobile homes on leased land, which VA will not. CalVet has programs for qualified Veterans that allow for $0 down. There are also programs available for some Veterans who may not be eligible for a VA loan but can still get CalVet. Typically, a small down payment is required. The interest rate is set by CalVet and always comes with a 1% Origination Fee, which means the Veteran has less flexibility with structuring a loan with low fees. (versus VA)

A Veterans First Step in the Homebuying Process

The first step in the homebuying process for a Veteran is to speak with a VA lender. While many Veterans will sometimes start by searching for a home, it could be frustrating if they later find that they don't qualify for the homes they are finding. Talk to the lender first. The lender will prequalify and prepare a VA Purchase Analysis which will have a breakdown of the numbers. This leads to PreApproval, which is important to have completed before making offers on homes.

For Veterans in Orange County who are looking for condos (versus a single family detached home), www.OrangeCountyVeteransHomes.com is a website that lists VA approved condos currently for sale.