The VA loan program is one of the only 100% financing home loan options available in the mortgage industry today. Available to eligible United States veterans, it allows for the purchase of a home with no down payment to purchase prices as high as $687,500 in Orange and Los Angeles Counties, CA and $1,050,000 in Contra Costa, San Francisco, Marin, Alameda, and San Mateo counties. Offering low fixed rates and no monthly mortgage insurance, the VA home loan program is truly one of a kind. But a common question does come up. What is the Funding Fee?

The VA loan program is one of the only 100% financing home loan options available in the mortgage industry today. Available to eligible United States veterans, it allows for the purchase of a home with no down payment to purchase prices as high as $687,500 in Orange and Los Angeles Counties, CA and $1,050,000 in Contra Costa, San Francisco, Marin, Alameda, and San Mateo counties. Offering low fixed rates and no monthly mortgage insurance, the VA home loan program is truly one of a kind. But a common question does come up. What is the Funding Fee?

*California county limits for VA Loans

The VA Funding Fee is a fee that is required in order to receive a VA loan. The amount of the Funding Fee is pre-determined by VA based on a several factors, depending on whether the Veteran has used their VA eligibility previously, the amount of down payment (if there is any), and whether or not the Veteran served in the “regular” military or the Reserves. And for some, the Funding Fee is waived. It’s important to note that the Funding Fee is sent directly to VA to go towards losses on loans that go into default.

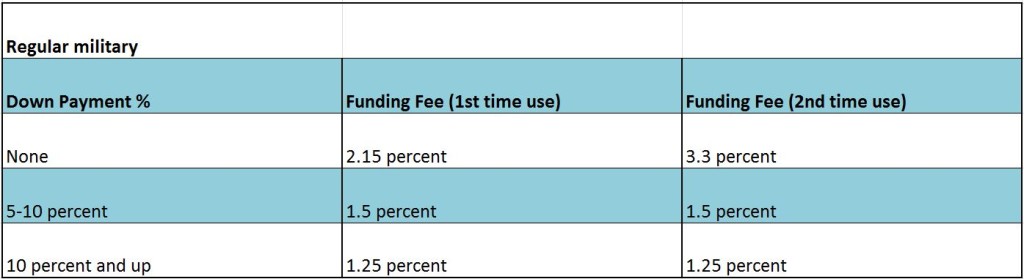

Below is the Funding Fee chart for those who served in the regular military.

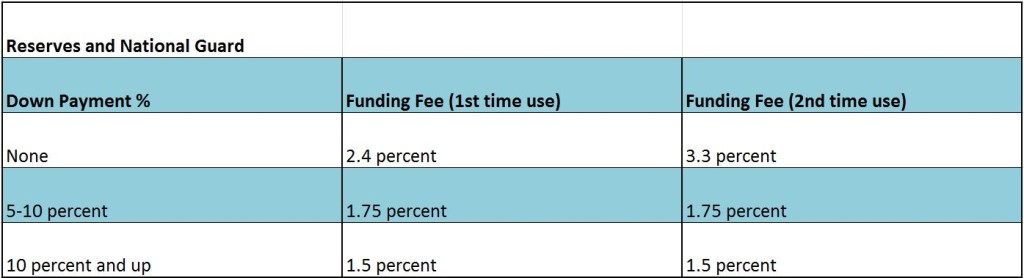

Below is the Funding Fee chart for those who served in the Reserves and National Guard

When is the VA Funding Fee Waived?

Below are circumstances when the VA Funding Fee is waived.

- Veterans who are getting VA compensation due to service related disabilities.

- Veterans who would be receiving VA compensation due to service related disabilities if they were not already receiving retirement pay.

- Loans for spouses of veterans who passed away in service or because of service related disabilities.

The Certificate of Eligibility will let the lender know whether or not a Funding Fee is to be charged.

How is the Funding Fee Paid?

The Funding Fee can be financed into the loan. For example, if a Veteran purchases a home in Orange County for $500,000 using 100% financing, the “base” VA loan would be $500,000. The Funding Fee ( assuming this the the Veterans first time using their entitlement) would be $10,750 ($500,000 * 2.15% = $10,750). If the Veteran chooses to finance the Funding Fee, as most do, then the total VA loan amount would be $510,750. The Veteran can also choose to pay the Funding Fee “out of pocket”, and in some cases the lender may even offer enough “lender credit” to pay cover the Funding Fee.

What about a VA Refinance?

The amount of Funding Fee on a refinance just depends on the type of refinance. The most common VA refinance is the IRRRL, or Interest Rate Reduction Refinance Loan. This is a VA to VA refinance with no cash out. The Funding Fee on an IRRRL is only .5%. For a refinance of a non-VA loan into a VA loan, or any “cash out” refinance, the Funding Fee is 3.3%.

Authored by Tim Storm, a California Mortgage Loan Officer MLO 223456 – Please contact my office at the Emery Financial. Direct line at 949-640-3102. www.OrangeCountyVALoans.com

Google+